Nigeria’s fintech industry is booming, and it’s changing the way people handle money. Whether you’re sending money to a friend, paying for groceries, or even saving for the future, these fintech companies make it easier, faster, and often cheaper. Let’s break down some of the biggest players in Nigeria’s fintech space right now.

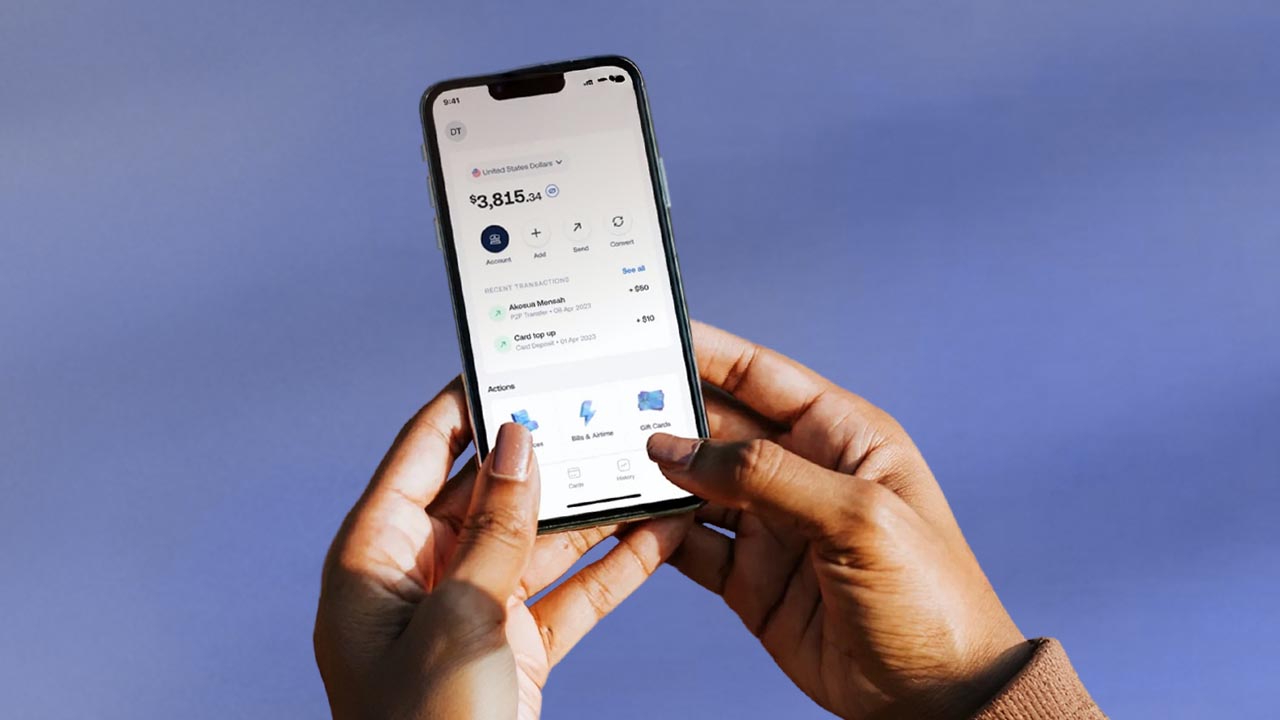

1. Grey

Grey makes it easy for Nigerians to receive payments from international clients. Imagine you’re a freelancer working for a company abroad—you don’t want the hassle of traditional banks delaying your money. Grey gives you a virtual foreign account so you can receive dollars, euros, or pounds and convert them to naira instantly.

2. Paystack

If you’ve ever bought something online in Nigeria, chances are you’ve used Paystack. It helps businesses accept payments from customers via cards, bank transfers, and even USSD. It’s like a digital cash register that businesses can rely on to get paid smoothly.

3. Opay

Opay is like a one-stop shop for financial services. You can use it to send and receive money, pay bills, buy airtime, and even take a loan. Plus, they have a ride-hailing and food delivery service. Think of it as a digital bank mixed with a mini marketplace.

4. PalmPay

PalmPay is another mobile money app that makes transactions easy. It’s known for its cashback rewards—so every time you pay for something, you might get a little money back. It’s like earning small change every time you shop!

5. MoMoPSB

Short for Mobile Money Payment Service Bank, MoMoPSB is MTN’s way of helping people send and receive money without a bank account. If you have an MTN line, you can access their services through USSD codes, making it super convenient for people without smartphones.

6. Kuda

Kuda is a full-fledged digital bank. Unlike traditional banks, it has no physical branches, meaning you can do everything from your phone. No hidden charges, no unnecessary fees—just simple banking.

7. Moniepoint

Moniepoint helps businesses accept payments easily. If you’ve ever paid with a POS machine at a small shop, it might have been Moniepoint’s. It also provides loans and banking solutions to small businesses.

8. Fincra

Fincra specializes in cross-border payments. If a business wants to send or receive money internationally, Fincra makes sure it happens quickly and smoothly. It’s a big deal for Nigerian companies that deal with foreign customers.

9. Paga

Paga is one of Nigeria’s oldest fintech companies. It lets you send money, pay bills, and make purchases without needing a bank account. Think of it as a digital wallet that works for everyone.

10. Carbon

Carbon isn’t just a payment platform; it also offers loans, savings, and investment options. If you need quick cash for an emergency, Carbon can lend you money without the long wait times of traditional banks.

11. FairMoney

Like Carbon, FairMoney is a digital lender that gives quick loans with minimal paperwork. It also has a banking service where you can open an account and save money.

12. Eversend

Eversend is a multi-currency wallet that allows users to send and receive money in different currencies. If you travel a lot or make international purchases, Eversend helps you manage foreign exchange rates easily.

13. Cowrywise

Cowrywise helps people save and invest their money wisely. It’s like a digital piggy bank that also grows your money by investing it in stocks, bonds, and other financial tools.

14. PiggyVest

PiggyVest is another savings and investment platform that helps Nigerians develop better money habits. It allows you to lock away funds so you don’t spend them impulsively. Piggyvest was co-founded by Odunayo Eweniyi, one of the most influential Nigerian women in Tech.

15. Remita

Remita is widely used by businesses and government agencies for managing payments. Whether it’s paying salaries, processing taxes, or handling large transactions, Remita makes sure the money moves efficiently.

16. Chipper Cash

Chipper Cash focuses on free and low-cost money transfers across Africa. If you need to send money to someone in Ghana or Kenya, for example, Chipper Cash makes it super easy and affordable.

17. Flutterwave

Flutterwave is one of Nigeria’s biggest fintech success stories. It provides payment solutions for businesses of all sizes, helping them accept payments from customers all over the world. Whether it’s a small business selling clothes on Instagram or a big company, Flutterwave makes payments seamless.

Comparison Table

| Fintech Company | Main Services | Best For |

|---|---|---|

| Grey | International payments | Freelancers, remote workers |

| Paystack | Online payment processing | Businesses, e-commerce |

| Opay | Mobile banking, bill payments | Everyday transactions |

| PalmPay | Mobile money, cashback rewards | Cashback lovers |

| MoMoPSB | Mobile money services | MTN users, rural areas |

| Kuda | Digital banking | People avoiding bank fees |

| Moniepoint | POS & business banking | Small businesses |

| Fincra | Cross-border payments | International transactions |

| Paga | Mobile payments, bill payments | People without bank accounts |

| Carbon | Digital lending, savings | Quick loans |

| FairMoney | Digital lending, banking | Short-term loans |

| Eversend | Multi-currency wallet | International money transfers |

| Cowrywise | Automated savings, investments | Long-term saving plans |

| PiggyVest | Savings, investment | People who struggle to save |

| Remita | Business & government payments | Large organizations |

| Chipper Cash | Free money transfers in Africa | Sending money abroad |

| Flutterwave | Business payment solutions | Small to large businesses |

Nigeria’s fintech industry is changing the way people interact with money. Whether you need a loan, want to save, or run a business, there’s a fintech company designed to help. As these companies continue to grow, banking and finance will only get easier for Nigerians. Which one do you use the most?

Subscribe to our Newsletter

Stay updated with the latest trends in African technology!