Ever Struggled With Receiving International Payments?

Let’s say you’re a graphic designer in Nigeria, and a client from the U.K. wants to pay you in pounds. Or maybe you sell products online, but your customers prefer paying in dollars or euros. Normally, this means dealing with high transfer fees, slow processing times, or exchange rate headaches. But what if there was a simpler way?

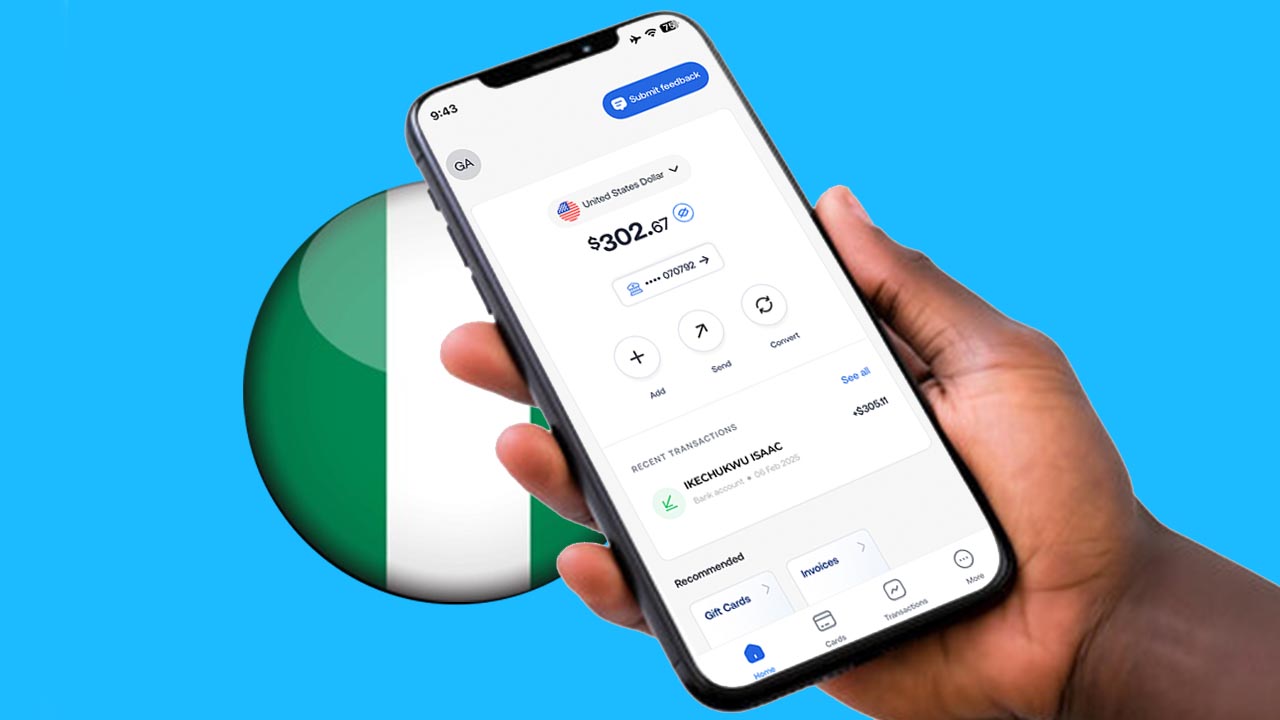

That’s where Grey comes in! Grey lets you open a US, UK, or EU foreign bank account from Nigeria, making it super easy to send and receive international payments, exchange currencies, and withdraw in Naira (NGN) without stress.

Let’s break it down so you can start using Grey today!

What is Grey, and Why Should You Use It?

Grey is a fintech platform that gives you foreign bank accounts without needing to travel. With Grey, you can open a USD, GBP, or EUR account from Nigeria and use it just like a local account in those countries.

This means:

- You can receive money from international clients hassle-free

- Convert your foreign currency to Naira instantly

- Withdraw to your local bank or mobile wallet with no hidden charges

- Use virtual cards to make payments in dollars or euros

Basically, it’s like having an international bank account—but 100% online and way easier to set up.

Why Open a Foreign Bank Account With Grey?

Here’s why Nigerians are switching to Grey for international banking:

- Get paid like a local in multiple currencies – Whether it’s USD, GBP, or EUR, Grey lets you receive payments directly into your foreign bank account.

- Instant withdrawals to Naira – No more waiting days to access your money.

- No unnecessary fees – Traditional banks charge crazy fees, but Grey keeps it simple and affordable.

- Virtual cards for global payments – Shopping online or subscribing to international services? Grey makes it easy.

- Perfect for freelancers, remote workers, and businesses – If you earn or spend in foreign currencies, Grey saves you time and money.

How to Open a Foreign Bank Account in Nigeria With Grey (In 3 Easy Steps!)

Unlike traditional banks, which require tons of paperwork, Grey’s process is completely online and takes just a few minutes. Here’s how:

Step 1: Sign Up on Grey

Visit Grey’s website or download the Grey mobile app. Create an account with your name, email, and phone number—it’s just like signing up for any other online service.

Step 2: Complete KYC Verification

To keep everything safe and compliant, Grey needs to verify your identity. You’ll need to:

- Upload a government-issued ID (National ID, Passport, or Driver’s License)

- Take a quick selfie for identity verification

- Provide proof of address (like a bank statement or utility bill)

This process ensures your account is secure and prevents fraud.

Step 3: Get Your Foreign Bank Account

Once verified, Grey provides you with a foreign bank account (USD, GBP, or EUR), and you’re ready to go! You can now send and receive international payments like a local.

How to Use Your Grey Foreign Bank Account

Now that you have your foreign account, what can you do with it?

1. Receive Payments From Anywhere

Freelancers, remote workers, and businesses can share their Grey account details with clients and get paid in their preferred currency.

2. Convert and Withdraw Money Easily

Received $500 in your Grey USD account? Convert it to Naira (NGN) at competitive exchange rates and withdraw it instantly to your local bank or mobile money wallet.

3. Make International Payments

Need to pay for Netflix, buy software, or shop online? Use Grey’s virtual cards to make payments in foreign currencies without any restrictions.

Frequently Asked Questions About Grey

1. Is Grey a Bank?

No, Grey is a fintech platform that partners with licensed financial institutions to provide foreign bank accounts and payment services.

2. Is Grey Safe?

Yes! Grey follows strict security measures, including encryption and identity verification, to keep your money and data safe.

3. How Long Does It Take to Open an Account?

Signing up takes a few minutes, and KYC verification usually takes between a few minutes to a few hours.

4. Are There Any Hidden Fees?

Nope! Grey is transparent about its fees, and you’ll always see the exchange rates before making a conversion.

Why You Should Open a Grey Foreign Account Today

If you earn or spend money in different currencies, Grey is the easiest and most affordable way to manage international transactions from Nigeria.

No paperwork.

No hidden fees.

Works from anywhere in Nigeria.

Instant withdrawals.

Ready to take control of your international finances? Sign up on Grey now and start receiving and sending payments like a pro! 🚀

Subscribe to our Newsletter

Stay updated with the latest trends in African technology!