In many African countries, there are restrictions on using international payment systems. Local bank cards sometimes don’t work on platforms like Netflix, especially when payments are required in dollars. Additionally, fees for currency conversion can be high. Virtual dollar cards solve these problems by providing access to international payments without unnecessary complications.

For example, imagine subscribing to Netflix, but your bank card fails. Or you find a great deal on AliExpress, but you face issues during payment. With a virtual dollar card, such situations can be avoided.

How to choose a virtual card

Before applying for a card, it’s important to consider:

- Payment currency. Dollars allow you to pay without conversion. This is convenient if you frequently shop on international platforms.

- Fees. Some cards have low maintenance costs, helping you save money.

- Limits. These are crucial for those who often make large payments.

- Availability. Make sure the card supports your region.

For instance, if you regularly buy clothing or electronics on AliExpress, check the card’s limits—both maximum and minimum. Keep in mind that limits are listed in dollars. Plan your expenses, including shipping and currency conversion.

If your main goal is a Netflix subscription, ensure the card is suitable for recurring monthly payments.

Top 3 virtual card services

The market offers many options, but we’ve selected three that provide reliability, ease of use, and favorable conditions. Here’s a breakdown of these services:

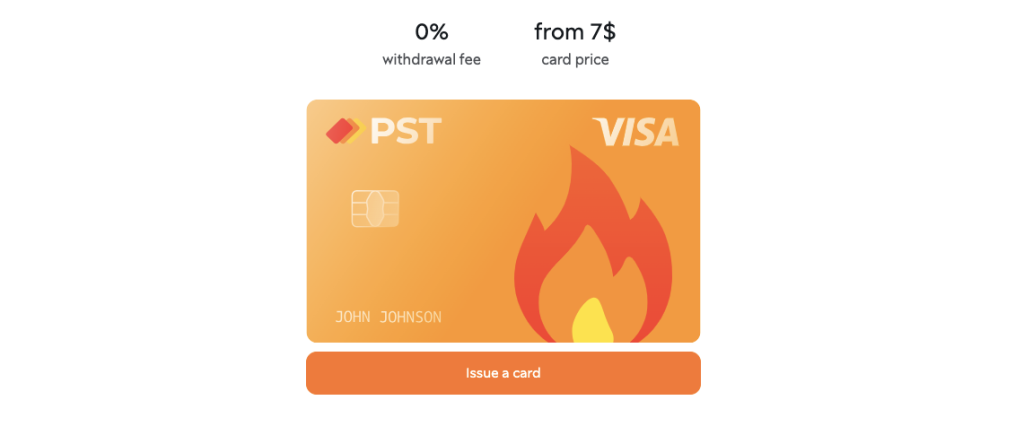

1. PSTNET

Ultima is a virtual dollar card from PSTNET. The service imposes no restrictions: Ultima cards let you spend as much as you want and issue an unlimited number of cards. There are no fees for payments or declined transactions. Funding costs 2% of the amount, and withdrawals in USDT are commission-free.

The cards operate on Visa and Mastercard networks, making them suitable for all kinds of online expenses. You can shop on platforms like AliExpress, Amazon, or eBay, pay for Netflix or Spotify, book hotels, buy plane tickets, and cover business expenses.

Key features:

- Security: 3D Secure and two-factor authentication are used.

- Flexible plans: Pay weekly or opt for an annual plan at a discounted rate of $99.

- Convenient bot: Use Telegram to receive 3D Secure codes and payment status updates.

- Funding options: Supports 18 cryptocurrencies, SWIFT/SEPA bank transfers, and other Visa or Mastercard cards.

- Easy registration: Sign up via Google, Telegram, Apple ID, or email.

- 24/7 support: Contact the team through Telegram, WhatsApp, or the website chat.

2. PayDay

PayDay is a platform for issuing virtual dollar cards for users in Africa. The service allows card management through a user-friendly mobile app. These cards are suitable for subscriptions, international purchases, and other online transactions.

Key features:

- Security: 3D Secure technology protects payments.

- Flexible plans: Available via the mobile app.

- Limits: The maximum spending limit per card is $10,000 per month.

- Convenient app: Issue cards, make payments, and manage finances with ease.

- Funding options: Popular cryptocurrencies and SWIFT/SEPA bank transfers are supported.

- Easy registration: Sign up through the app; verification requires documents.

- 24/7 support: Contact the team via the app or email.

3. Geegpay

Geegpay is a financial platform designed for freelancers, remote workers, and professionals in Africa. The service offers virtual dollar cards, multi-currency accounts, and convenient payment solutions for popular shopping platforms and digital marketplaces. Fees include $0.50 per transaction, with top-up rates starting at 2%.

Key features:

- Security: 3D Secure technology ensures payment safety.

- Flexible plans: Manage cards and payments through the app.

- Limits: Depend on the card’s plan.

- Convenient app: Issue cards, make payments, and manage finances via a digital wallet.

- Funding options: Includes support for some local bank cards.

- Easy registration: Create and top up a digital wallet through the mobile app.

- 24/7 support: Reach the team through the app.

How to ensure safety

Virtual cards have built-in protection mechanisms, but users should also stay vigilant:

- Never share your virtual card details with strangers

- Use two-factor authentication whenever possible

- Do not disclose your 3D Secure code to anyone

- Verify websites before entering your card details

For safe payments on AliExpress, always check seller reviews and choose trusted stores.

Virtual dollar cards help people in Africa make payments and subscriptions where local bank cards don’t work. They enable payments for Netflix, shopping on AliExpress, booking hotels, and buying tickets. Cards should be chosen based on three factors: fees, limits, and supported regions.

For example, PSTNET offers unlimited spending, PayDay provides management through a user-friendly app, and Geegpay offers multi-currency accounts.To use cards safely, enable two-factor authentication, don’t share your card details, and verify websites before making payments. Virtual cards simplify access to international purchases and save time, making online shopping convenient and secure.

Subscribe to our Newsletter

Stay updated with the latest trends in African technology!