If you live in Africa and have ever tried to pay for a Netflix subscription, chances are you’ve hit a wall.

Many global platforms like Netflix, Amazon, YouTube Premium, Google Ads, to name a few simply won’t accept African-issued debit or credit cards. Whether it’s a streaming subscription, ad spend for your business, or software for freelance work, access is often cut off by payment friction. The solution? Virtual USD cards.

Many African bank cards are region-locked or come with restrictions. Some don’t support foreign currency transactions, while others are blocked by merchants using MCC (Merchant Category Code) filters such as “Digital Goods” or “Advertising Services.” If you’re based outside the US or Europe, this could mean losing access not just to entertainment, but to tools critical for earning a living online.

Enter virtual dollar cards — fintech-powered alternatives to traditional banking that let users pay in USD without needing a foreign bank account. These cards are typically issued by startups, not banks, and are designed to be instantly accessible and globally compatible.

In this guide, we explore three standout platforms Spend.net, Chipper Cash, and Geegpay, and what you need to check before signing up.

Four things to check before choosing a virtual USD card

1. Licensing and regulation

Always look for platforms that are registered in jurisdictions with robust financial oversight—think the UK, US, or Lithuania. Regulation means more transparency and accountability, reducing the risk of sudden service shutdowns or frozen funds.

2. Payment network integration

Not all “virtual” cards are created equal. Some lack proper international BINs (Bank Identification Numbers) and fail verification on platforms like Google or Amazon. Make sure the provider issues genuine Visa or Mastercard cards with full merchant compatibility.

3. Funding options

Top-up options matter. The best platforms let you fund your account in dollars via crypto (like USDT), SEPA transfers, SWIFT, or even local currency—at transparent and reasonable exchange rates.

4. Fees and limits

Some services charge 1–3% per transaction or impose hefty fees for card issuance. Others make it difficult or impossible to withdraw your funds. Always read the fine print before creating a card.

Top three platforms for virtual dollar cards

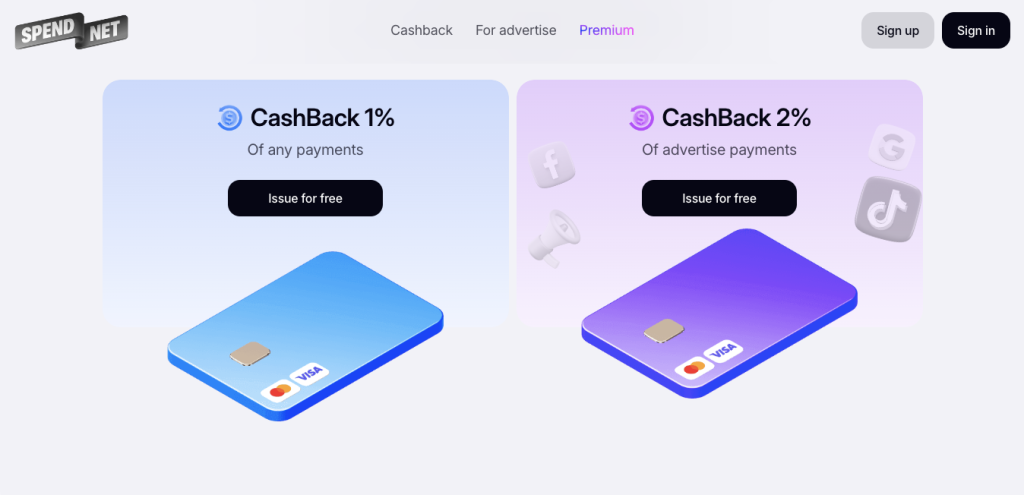

- Spend.net

Spend.net is a global fintech platform offering virtual Visa and Mastercard cards with built-in 1% cashback on all online purchases. Whether you’re paying for Netflix, running Facebook ads, or buying SaaS tools, Spend.net is built for uninterrupted access to international digital services.

What sets it apart? Cashback is automatic – no activation, no hoops to jump through, and applies to everything from subscriptions to e-commerce purchases. Users can also tweak the top-up fee when adding funds, giving them more control over transaction costs. On average, fees sit at around 2%, but this can be adjusted based on the needs of each payment.

All cards come with 3D Secure by default, which helps prevent fraud and unauthorised charges. That’s especially important when dealing with sensitive platforms like ad networks or subscription services.

Key features:

- Security: 3D Secure enabled

- Funding: Supports USDT, BTC

- Easy onboarding: Google sign-in or email registration

- Customer support: 24/7 live chat in the user dashboard

- Chipper Cash

Operating across 21 African countries, Chipper Cash offers a virtual Visa card specifically tailored for the region. It’s especially popular in Nigeria, where users can hold balances in both Naira and USD.

The card enables seamless payments on global platforms—from streaming sites to cloud software. Thanks to its multi-currency wallet, users can top up in local currency and spend in dollars, avoiding unnecessary conversion fees or the need for a foreign bank account.

Top-ups are done via the internal Chipper wallet and transferred instantly to the card—no delays, no added charges. This is a huge plus when timing is critical, such as funding ad campaigns or maintaining active subscriptions.

Key features:

- Security: Identity verification, 2FA

- Funding: Internal wallet, instant transfer with zero fees

- Registration: Via mobile app, document verification required

- Support: Help centre, phone and email support

- Geegpay

Initially built for African freelancers paid in USD, Geegpay has grown into a full-fledged virtual card provider supporting all types of digital transactions. The platform offers Visa debit cards tied to a multi-currency wallet that supports both USD and Naira.

With built-in FX tools, Geegpay allows users to manage currency conversions and transfers in real time. It’s ideal for anyone juggling USD expenses and income in local currency.

The platform also supports p2p transfers, letting users send money to each other, convert currencies, and top up cards—all from within the Geegpay ecosystem. These internal processes are fast and carry low fees, bypassing the need for third-party banks or exchanges.

Key features:

- Security: ID verification with selfie confirmation

- Funding: Multi-currency wallet with internal FX tools

- Registration: Through mobile app, card setup under “Cards” section

- Support: In-app chat (available after verification)

For many in Africa, virtual USD cards aren’t just a payment tool, they’re a digital lifeline. Whether you’re streaming your favourite show, running a small business, or freelancing for clients abroad, platforms like Spend.net, Chipper Cash, and Geegpay provide vital access to the global economy.

Each provider offers its own strengths:

- Spend.net focuses on cashback and flexible fees

- Chipper Cash simplifies currency management and removes friction

- Geegpay supports remote work with a scalable ecosystem

What unites them is a commitment to inclusion, empowering users with tools to engage with the world, no matter where they’re based. Understanding how these cards work isn’t just about convenience. It’s about enabling digital freedom, unlocking new income streams, and building a more connected financial future.

And that, quite frankly, changes everything.

Subscribe to our Newsletter

Stay updated with the latest trends in African technology!