Sending money to South Africa should be easy, secure, and fast. Whether you’re supporting family, paying for services, or handling business transactions, picking the right platform is essential. With so many options, how do you choose the best one? Don’t worry—I’ve got you covered. Let’s break it down in a way that makes sense, like explaining a game plan to a friend.

How to Identify a Good Money Transfer Platform

Before we jump into the list, here’s what to look for in a reliable money transfer service:

- Security – Your money should be protected from fraud and scams.

- Speed – Some transfers happen instantly, while others take a few days.

- Fees – Look for low or no fees to save on costs.

- Exchange Rates – Some platforms offer better rates than others.

- Ease of Use – The platform should be simple to navigate.

- Payment Methods – Options should include bank transfers, mobile wallets, and cash pickups.

Now, let’s explore 12 trusted platforms that make sending money to South Africa seamless and secure.

1. Western Union

Why it’s great:

- Large global network with thousands of locations.

- Western Union supports bank deposits, cash pickup, and mobile money.

- Multiple payment options, including credit/debit cards and bank transfers.

Best for: Sending money to someone who prefers picking up cash in person.

2. MoneyGram

Why it’s great:

- MoneyGram is fast and widely available.

- Supports cash pickup, mobile money, and bank deposits.

- Convenient for in-person transactions at numerous locations.

Best for: Those who need fast cash pickups or in-person transfers.

3. WorldRemit

Why it’s great:

- WorldRemit supports bank deposits, mobile money, and cash pickups.

- Transfers are typically completed within minutes.

- Reasonable fees with competitive exchange rates.

Best for: People who want multiple transfer options, including mobile wallets.

4. Remitly

Why it’s great:

- Express (instant) and Economy (cheaper but slower) options.

- Works with bank deposits, mobile money, and cash pickup locations.

- Special exchange rate promotions for first-time users.

Best for: First-time senders looking for a good deal.

5. Paysend

Why it’s great:

- Low flat transfer fee (about $2 per transaction).

- Fast transactions, often completed within minutes.

- Supports direct bank account and mobile wallet transfers.

Best for: Those who want a low-cost, fast, and transparent pricing option.

6. Skrill

Why it’s great:

- Allows sending money through a digital wallet.

- Offers low-cost transactions compared to traditional banks.

- Ideal for online purchases and payments as well.

Best for: Digital-savvy users who want a multi-purpose wallet for money transfers and online payments.

7. TransferGo

Why it’s great:

- Fast transfers, sometimes as quick as 30 minutes.

- Competitive exchange rates.

- Supports direct bank deposits.

Best for: Those who need quick and reliable bank transfers.

8. ACE Money Transfer

Why it’s great:

- Competitive exchange rates.

- Multiple payout options: bank deposits, mobile wallets, and cash pickup.

- ACE Money Transfer is trusted by many users sending money to South Africa.

Best for: People who want flexible payout options with good exchange rates.

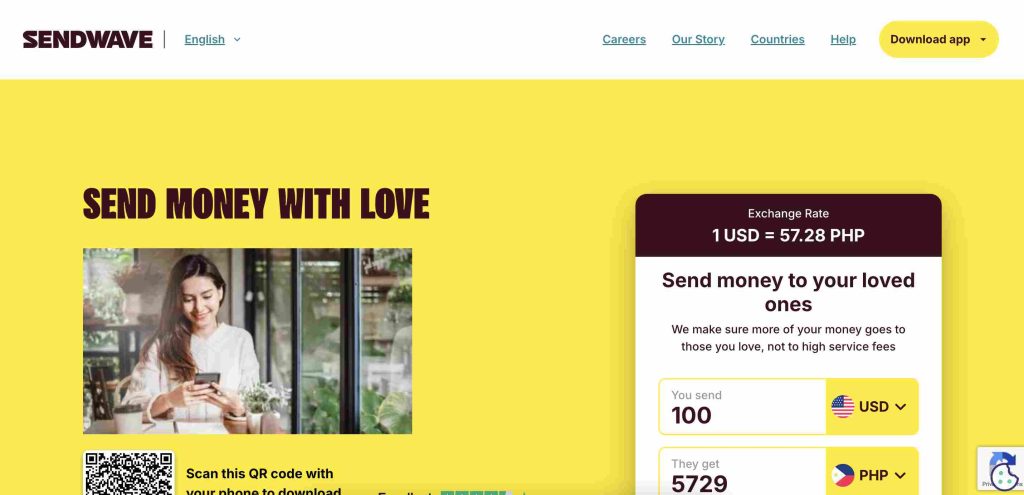

9. Sendwave

Why it’s great:

- No fees for transfers.

- Fast transactions, often within minutes.

- Sendwave works with major mobile money providers.

Best for: Those who want a fee-free and instant way to send money to mobile wallets.

10. Taptap Send

Why it’s great:

- With Taptap Send, there are no fees on transfers.

- Fast and direct deposits to mobile money accounts.

- Easy-to-use mobile app for seamless transfers.

Best for: Mobile money users who want quick and free transfers.

11. LemFi

Why it’s great:

- Zero transaction fees.

- Supports multiple currencies for international transfers.

- LemFi works well for South Africans living abroad who send money home frequently.

Best for: People who want fee-free international transfers with multi-currency support.

12. Remitbee

Why it’s great:

- No fees for bank transfers over $500.

- Strong exchange rates compared to banks.

- Remitbee is ideal for Canadians sending money abroad.

Best for: Those in Canada who need a reliable and affordable way to send money to South Africa.

Comparing the Best Options

Here’s a quick comparison to help you pick the right service:

| Platform | Fees | Speed | Payment Methods | Best For |

|---|---|---|---|---|

| Western Union | Varies | Fast | Bank, mobile, cash | Cash pickups worldwide |

| MoneyGram | Varies | Fast | Bank, mobile, cash | In-person and urgent transfers |

| WorldRemit | Low | Fast | Bank, mobile, cash | Multiple transfer options |

| Remitly | Low | Varies | Bank, mobile, cash | First-time users & flexible options |

| Paysend | $2 | Fast | Bank, mobile | Low-cost transfers |

| Skrill | Low | Fast | Digital wallet | Online payments & money transfers |

| TransferGo | Low | Fast | Bank deposits | Quick bank transfers |

| ACE Money Transfer | Low | Fast | Bank, mobile, cash | Competitive exchange rates |

| Sendwave | No | Fast | Mobile money | Instant, fee-free transfers |

| Taptap Send | No | Fast | Mobile money | Fee-free mobile money transfers |

| LemFi | No | Fast | Multi-currency | No-fee transfers |

| Remitbee | No (over $500) | Fast | Bank deposits | Canadians sending money |

The best money transfer platform for you depends on what matters most—speed, cost, or payout methods. For fee-free mobile transfers, Sendwave and Taptap Send are solid options. If you’re after competitive exchange rates, consider TransferGo or ACE Money Transfer. Need cash pickup? Western Union or MoneyGram may be the best fit.

Whichever platform you choose, you can be confident that all of these are safe and reliable options for sending money to South Africa.

Subscribe to our Newsletter

Stay updated with the latest trends in African technology!