Investing is one of the smartest ways to grow your money, but with so many platforms available, it can be overwhelming to decide where to start. Whether you’re looking for stocks, mutual funds, real estate, or even cryptocurrency, there’s an investment platform in Nigeria for you. Let’s break it down in a simple, easy-to-follow way.

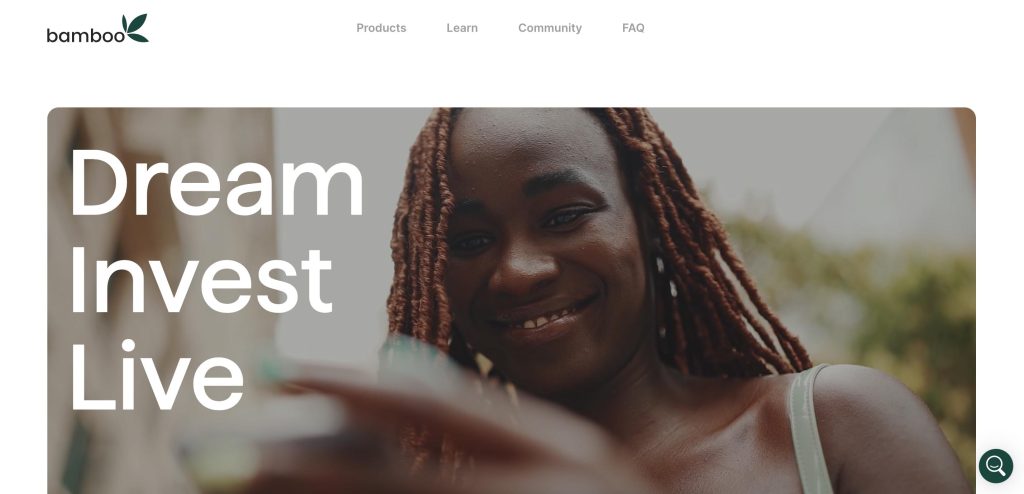

1. Bamboo

Bamboo allows Nigerians to invest in U.S. and Nigerian stocks right from their phones. You can buy shares in companies like Apple, Tesla, and Amazon with as little as $10. Bamboo also offers a “US Wallet” feature that lets you hold your funds in dollars, protecting them from naira depreciation.

Key Features:

- Invest in Nigerian and U.S. stocks

- Fractional shares available (own a piece of a stock)

- SEC-regulated for security

- Real-time market data

2. Chaka

Chaka provides access to over 4,000 stocks across Nigeria and international markets. If you want to diversify your investments, Chaka is a great choice. It allows you to open dollar and naira accounts, making it flexible for different currencies.

Key Features:

- Invest in Nigerian, U.S., and global stocks

- SEC-licensed for safety

- Knowledge Base for beginners

3. Risevest

Risevest is a great option if you want professionals to manage your investments. They offer portfolios in U.S. stocks, real estate, and fixed-income assets. This is perfect for people who prefer a hands-off approach.

Key Features:

- Professional portfolio management

- Invest in U.S. stocks, real estate, and bonds

- No Nigerian stock options

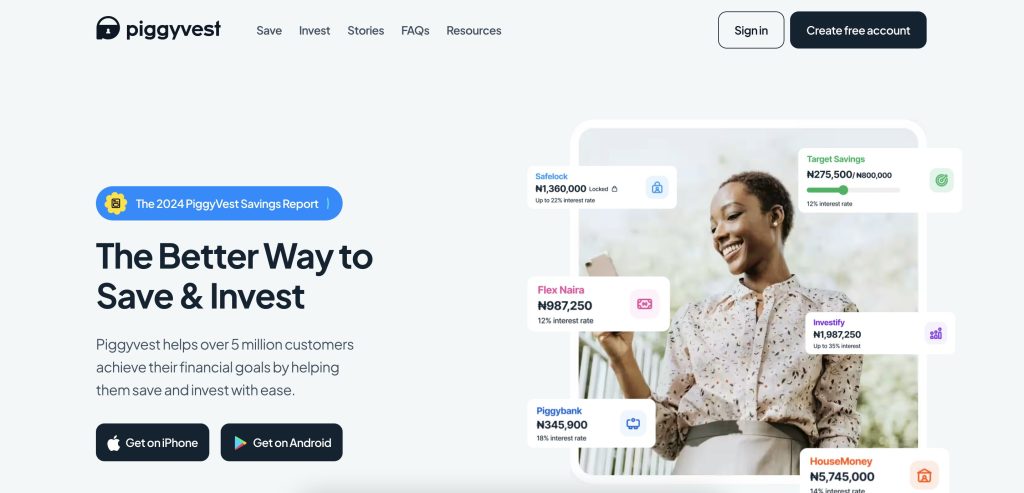

4. PiggyVest

PiggyVest, co-founded by Odunayo Eweniyi, one of Nigeria’s top tech women, started as a savings platform but has expanded to offer investment options. It allows users to invest in real estate, government bonds, and other assets with as little as ₦5,000.

Key Features:

- User-friendly app for investing and saving

- Real estate and fixed-income investment options

- Best for beginners looking to save and invest

5. Trove

Trove offers a mix of traditional and digital investments. With Trove, you can invest in Nigerian and global stocks, ETFs, bonds, and even cryptocurrencies.

Key Features:

- Over 10,000 investment options

- Start with as little as ₦1,000 or $10

- Includes cryptocurrency investments

6. Cowrywise

Cowrywise is designed for those who want to automate their savings and investments. It focuses on mutual funds and does not offer stocks, making it great for long-term wealth building.

Key Features:

- Invest in low, medium, and high-risk mutual funds

- Automated savings feature

- Investment circles for group investing

7. Quidax

If you’re interested in Bitcoin, Ethereum, and other digital currencies, Quidax is a great option. It offers a simple way to buy, sell, and store crypto assets.

Key Features:

- Easy-to-use crypto trading platform

- Secure wallet for storing digital assets

- Approved by the Nigerian SEC

8. I-Invest

I-Invest is best for those looking for safe, low-risk investments like Treasury bills, Eurobonds, and mutual funds.

Key Features:

- Invest in Treasury bills and bonds

- Fixed returns with lower risk

- Savings plans with up to 11% interest per year

9. GetEquity

GetEquity allows you to invest in startups and high-growth companies in Africa. This is a high-risk, high-reward investment option.

Key Features:

- Invest in early-stage African startups

- Venture capital and equity funding

- High potential returns

10. Crowdyvest

Crowdyvest focuses on funding impactful projects in sectors like agriculture, real estate, and transportation. This is perfect for those who want their investments to drive social change.

Key Features:

- Invest in agriculture, real estate, and transport projects

- Minimum investment starts at ₦20,000

- Community-driven investment approach

Quick Comparison Table

| Platform | Best For | Investment Options | Minimum Investment |

|---|---|---|---|

| Bamboo | Stocks | Nigerian & U.S. stocks | $10 |

| Chaka | Stocks | Nigerian & global stocks | Varies |

| Risevest | Managed portfolios | U.S. stocks, real estate, bonds | Varies |

| PiggyVest | Beginners | Savings, real estate, bonds | ₦5,000 |

| Trove Finance | Diversification | Stocks, ETFs, bonds, crypto | ₦1,000 / $10 |

| Cowrywise | Automated investing | Mutual funds | Varies |

| Quidax | Cryptocurrency | Bitcoin, Ethereum, other cryptos | Varies |

| I-Invest | Low-risk investors | Treasury bills, bonds, mutual funds | Varies |

| GetEquity | High-risk, high-reward | Startup investments | Varies |

| Crowdyvest | Impact investors | Agriculture, real estate, transport | ₦20,000 |

Choosing the Right Investment Platform

When choosing an investment platform, consider the following:

- Your Goals: Do you want short-term or long-term returns? Stocks and real estate are great for long-term growth, while Treasury bills offer stability.

- Risk Tolerance: Are you comfortable with high-risk investments like crypto and startups, or do you prefer safe options like bonds?

- Platform Fees: Some platforms charge transaction fees, while others take a percentage of your profits.

- Ease of Use: Beginners may prefer user-friendly platforms like PiggyVest or Cowrywise.

FAQs

What is the best investment platform in Nigeria?

It depends on your goals. Bamboo and Chaka are great for stocks, while PiggyVest and Cowrywise are best for beginners. If you want cryptocurrency, Quidax is a strong option.

Can I invest in U.S. stocks from Nigeria?

Yes! Platforms like Bamboo, Chaka, and Trove allow Nigerians to invest in U.S. stocks.

Are these investment platforms safe?

Yes, most are regulated by the Securities and Exchange Commission (SEC). However, always do your research before investing.

What’s the minimum amount needed to start investing?

You can start with as little as ₦1,000 on Trove, while others require ₦5,000 or more.

There’s no one-size-fits-all investment platform. The best one for you depends on your financial goals, risk appetite, and investment interests. Whether you’re looking for stocks, bonds, real estate, or crypto, Nigeria has an investment platform for you. Start small, stay consistent, and watch your money grow!

Subscribe to our Newsletter

Stay updated with the latest trends in African technology!