Buy Now, Pay Later (BNPL) services are transforming how Africans shop, making it easier for people to afford everyday items without paying the full price upfront.

Instead of waiting months to save up, BNPL allows customers to get what they need now and spread the payments over time. While global platforms like Fingerhut have long offered similar installment-based shopping options, Africa’s BNPL startups are now making waves in this growing industry. Let’s explore the top BNPL startups in Africa driving this change.

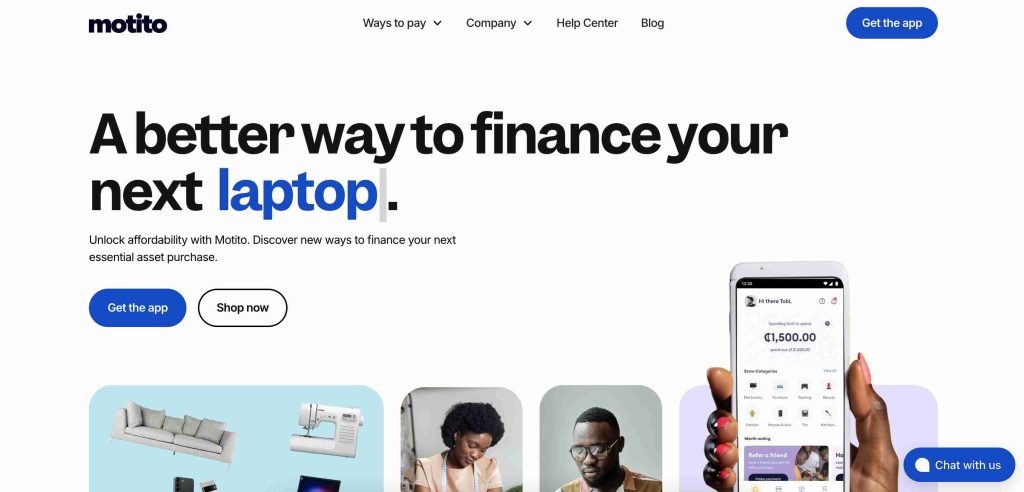

1. Motito

Founded in 2021, Motito is a fast-rising BNPL platform that enables shoppers to purchase a wide range of products, from fashion to electronics, and pay in installments. Customers can choose flexible repayment options that match their budget, making big purchases more manageable.

Why Motito Stands Out:

- Quick approval process

- Easy-to-use platform

- Multiple payment plans

- Partnerships with local merchants

Motito’s ability to collaborate with retailers has made it a top choice among African shoppers.

2. CDcare

CDcare was founded in 2020 by Oluwatobi Odukoya and Ayodeji Farohun to help Nigerians acquire electronics and smartphones without paying the full cost upfront. The platform requires a small deposit, after which users can pay the balance in monthly installments.

What Makes CDcare Special:

- Ideal for buying smartphones and electronics

- Simple tracking of installment payments

- Affordable options for premium devices

- Growing popularity among tech-savvy Nigerians

3. Payflex

Based in South Africa and founded in 2017, Payflex has revolutionized online shopping by allowing customers to split payments into four interest-free installments. This makes it easier for people to afford items without financial strain.

| Feature | Details |

|---|---|

| Founded | 2017 |

| Location | South Africa |

| Installments | 4 interest-free payments |

| Growth Rate | 119% over 5 years |

Payflex’s strong performance is backed by $500K in funding and a growing base of satisfied customers.

4. Mobicred

Mobicred, founded in 2013, is one of South Africa’s oldest BNPL platforms. Instead of a fixed installment plan, it offers customers a revolving credit facility, allowing them to make multiple purchases and repay at their own pace.

Key Benefits of Mobicred:

- Access to thousands of retailers

- Single monthly repayment option

- Credit limit that resets as payments are made

This approach has made Mobicred a go-to option for South Africans looking for flexible credit solutions.

5. Carbon

Carbon started as a digital bank in Nigeria but later introduced BNPL services. Since 2016, it has helped users make purchases both online and in-store with a four-installment, zero-interest payment plan.

What Makes Carbon Unique:

- Interest-free installment plans

- User-friendly app

- Expanding network of partner stores

- Supports financial inclusion in Nigeria

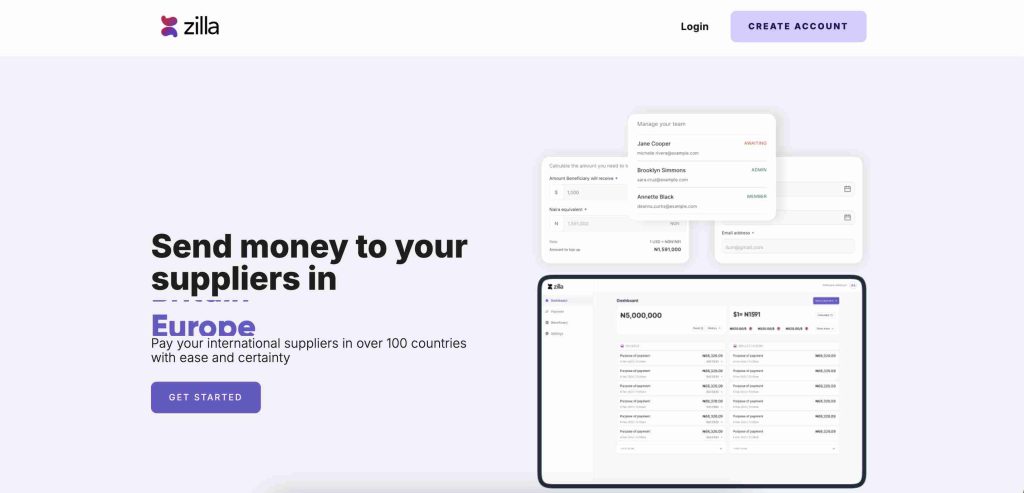

6. Zilla

Launched in 2020 in Lagos, Zilla simplifies BNPL by allowing shoppers to split payments into smaller chunks, reducing financial stress. Merchants also benefit from increased sales as more customers can afford to shop.

Why People Love Zilla:

- Boosts sales for merchants

- Flexible installment plans

- Popular among small and big retailers

- Strong presence in Nigeria’s e-commerce space

7. Lipa Later

Lipa Later is a leading BNPL provider in East Africa, founded in 2018 in Nairobi, Kenya. The company operates in Kenya, Uganda, and Rwanda, offering installment payments for electronics and household goods.

| Feature | Details |

| Founded | 2018 |

| Headquarters | Nairobi, Kenya |

| Countries | Kenya, Uganda, Rwanda |

| Focus | Electronics, household items |

Lipa Later’s strategic partnerships with e-commerce platforms have made it a major player in East Africa.

8. CredPal

CredPal, founded in 2018, is one of Nigeria’s top BNPL platforms. It works by allowing customers to make purchases using credit at the point of sale, which they can pay off later in flexible installments.

What Makes CredPal a Market Leader:

- Large network of merchants

- Easy access to credit

- Expanding services beyond Nigeria

CredPal continues to attract users looking for simple and reliable financing options.

9. EasyBuy

EasyBuy, founded in 2019, specializes in helping Nigerians afford smartphones and electronics through installment payments. It has built a strong reputation by partnering with phone retailers to offer installment plans directly in stores.

EasyBuy’s Key Features:

- Focuses on smartphones and gadgets

- In-store financing available

- Accessible to a wide range of income levels

10. PayJustNow

PayJustNow is a major BNPL provider in South Africa, offering shoppers a way to divide their payments into three equal, interest-free installments. Since its launch in 2019, the platform has gained popularity for its ease of use and focus on responsible spending. In 2022, Weaver Fintech acquired PayJustNow, boosting its expansion and market presence. The service is available at numerous online and physical stores, giving consumers greater flexibility in managing their purchases.

Why PayJustNow Is Gaining Traction:

- Seamless payment process

- Attractive to younger demographics

- Helps businesses increase customer spending

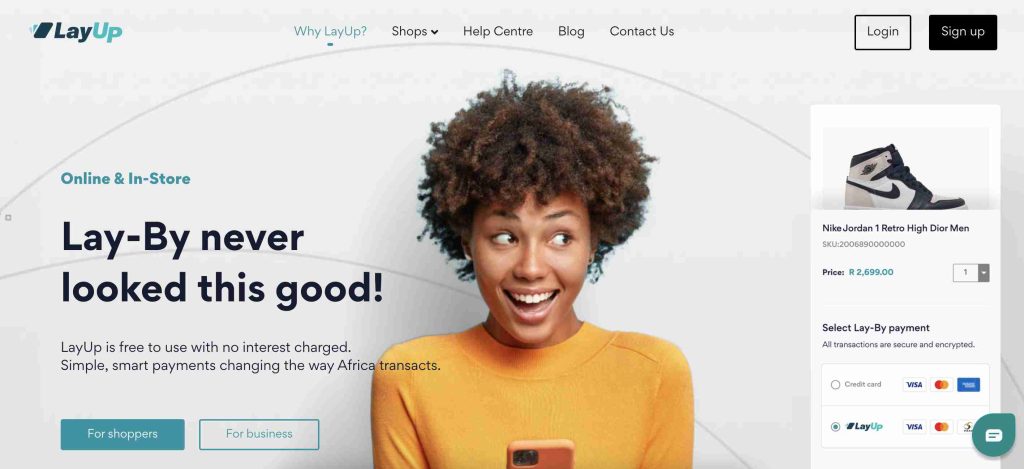

11. LayUp

LayUp is a South African BNPL provider that simplifies payments for consumers. Founded in 2019, the platform enables customers to pay in interest-free installments, offering better financial control. LayUp has grown by integrating its service into various industries, including healthcare, education, and retail. Unlike many BNPL services focused on everyday shopping, LayUp prioritizes essential purchases, making financial flexibility available for critical expenses beyond consumer goods.

The Future of BNPL in Africa

BNPL services in Africa are growing fast, making shopping more affordable for millions of people. With companies expanding into more regions and improving their offerings, customers can expect even more flexible and accessible payment solutions.

As financial technology (fintech) continues to evolve, BNPL is set to play a bigger role in bridging the credit gap in Africa, making essential goods and services more accessible to everyone. Whether you’re looking for a new smartphone, household appliances, or even fashion items, there’s a BNPL provider ready to help you buy now and pay later!

Subscribe to our Newsletter

Stay updated with the latest trends in African technology!