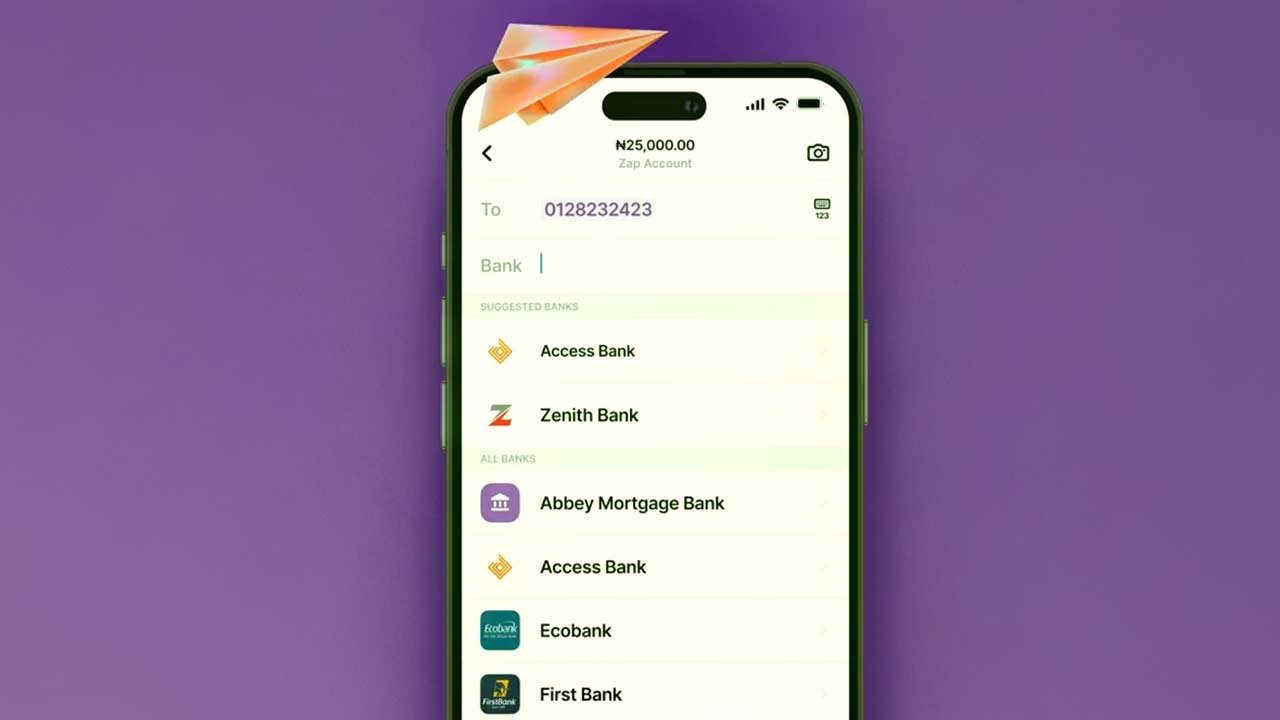

Paystack just dropped a new product, and if you’re tired of clunky bank apps or high transaction fees, this one’s worth paying attention to. It’s called Zap, a consumer app designed for instant and secure bank transfers—no card networks involved.

They made the announcement during a live stream on their YouTube page, keeping things direct and transparent, just how they like it.

Right now, the digital payments space is packed. You’ve got mobile money, digital wallets, and bank apps all fighting for attention. But Zap is taking a different approach. Instead of routing payments through card networks, which can add extra fees and sometimes slow things down, it sticks to good old bank transfers. That means lower costs and fewer middlemen.

How does Zap work?

Zap isn’t reinventing the wheel—it’s just making it run smoother. Here’s what to expect:

| Feature | What It Means for You |

|---|---|

| Instant Bank Transfers | No waiting around—money moves in real-time. |

| Secure Transactions | Built on Paystack’s existing system, which already processes millions of payments daily. |

| Easy to Use | No complicated setup, just straightforward money transfers. |

Where is it available?

Right now, Zap is live in Nigeria. But Paystack isn’t stopping there—they have plans to roll it out in other markets soon.

Africa’s digital payments space is booming. More people want quick, reliable ways to send and receive money without dealing with unnecessary fees or complicated apps. Zap is banking on the idea that consumers want a smoother, cheaper experience without the usual friction that comes with traditional banking apps. If it takes off, it could push other fintech players to rethink their approach too.

For now, if you’re in Nigeria and want a no-fuss way to send and receive money, Zap might be worth checking out.

Subscribe to our Newsletter

Stay updated with the latest trends in African technology!